Why your pet may be better insured than you

If you have a pet, you’ll know how expensive vet bills can be.

And, like 6.6 million other pet owners in the UK, you may have bought an insurance policy to prevent Fido’s latest mishap, or Mr Tibbs’ unexpected op, causing you serious financial hardship in the future.

But surprisingly, it seems many of us don’t apply the same care and consideration to ourselves.

It’s estimated that around 7 million people lack insurance that would help their loved ones avoid financial hardship in the event of their own unexpected death.

It’s estimated that around 7 million people lack insurance that would help their loved ones avoid financial hardship in the event of their own unexpected death.

How life insurance can make a difference

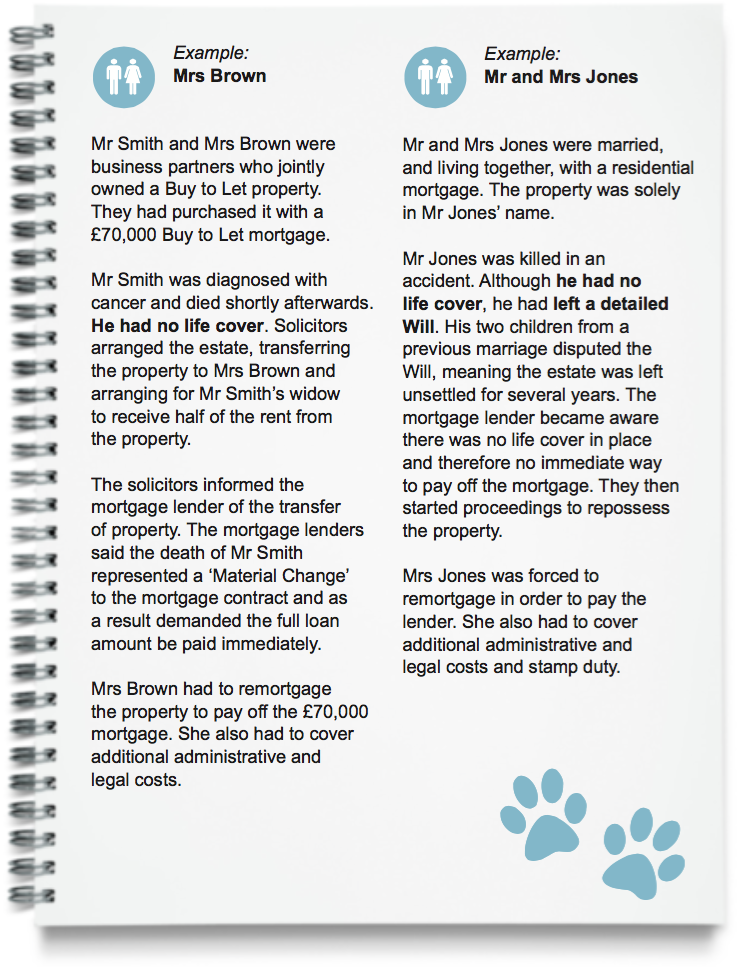

Managing unexpected vet’s bills without appropriate insurance can be a real struggle, but it’s nothing compared to the risks that under- insured homeowners – and their families – might face. The following real-life examples illustrate how dying without life insurance can have a catastrophic effect on those left behind.

Have you insured what matters most?

If the unexpected happens, the right insurance can make all the difference.

Appropriate protection, such as life or critical illness cover (written in trust) can help you, your business partners or your loved ones avoid financial difficulty at an already traumatic time.

Content reproduced by permission of Openwork Ltd.