Pension Savers Face Lifetime Allowance cut

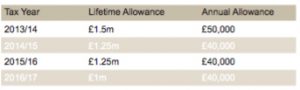

From 5 April 2016, your tax-free pensions savings limit will be cut from £1.25m to £1m. This cap is called the ‘lifetime allowance’ and applies to your entire pension savings (apart from the state pension).

When the lifetime allowance was first introduced in 2006, it only affected high earners in the UK who could afford to grow seven- figure pension pots.

But as the limit has reduced in recent years many more thousands of people have been affected – especially those in final-salary schemes who have built their entitlement through many years’ work.

Tax charges

If your pension savings are worth more than the £1m lifetime allowance when you take your bene ts, you’ll have to pay the lifetime allowance tax charge on the excess. The tax charge is 55% if you take the excess pension pot as a lump sum, or 25% if you take the pension as a regular payment.

Annual allowance

The amount you can pay into your pension every year (the annual allowance) is currently £40,000. You usually pay tax if savings in your pension pot exceed the annual allowance, but you can top up your allowance for the current tax year (6 April to 5 April) with any allowance you didn’t use from the previous three tax years.

Pensions savings allowances

Protecting your money

Applying for Individual Protection 2014

Contains public sector information licensed under the Open Government Licence v3.0.